Growth vs. Value

Growth vs. Value: Two Approaches to Stock Investing

Growth and value are two fundamental approaches, or styles, in stock and stock mutual fund investing. Growth investors seek companies that offer strong earnings growth, while value investors seek stocks that appear to be undervalued in the marketplace. Because the two styles complement each other, they can potentially add diversity to your portfolio when used together.

Growth and Value Defined

Growth stocks represent companies that have demonstrated better-than-average gains in earnings in recent years and that are expected to continue delivering high levels of profit growth, although there are no guarantees. “Emerging” growth companies are those that have the potential to achieve high earnings growth, but have not established a history of strong earnings growth.

The key characteristics of growth funds are as follows:

- Higher priced than broader market. Investors are typically willing to pay high price-to-earnings multiples with the expectation of selling them at even higher prices as the companies continue to grow.

- High earnings growth records. While the earnings of some companies may be depressed during period of slower economic improvement, growth companies may have the potential to achieve high earnings growth in different economic environments.

- More volatile than broader market. The risk in buying a given growth stock is that its lofty price could fall sharply on any negative news about the company, particularly if earnings disappoint on Wall Street.

Value fund managers look for companies that have fallen out of favor but still have good fundamentals. The value group may also include stocks of new companies that have yet to be discovered by investors.

The key characteristics of value funds include:

- Lower priced than broader market. The idea behind value investing is that stocks of good companies will bounce back in time if and when the true value is recognized by other investors.

- Priced below similar companies in industry. Many value investors believe that a majority of value stocks are created due to investors’ overreacting to recent company problems, such as disappointing earnings, negative publicity or legal problems, all of which may raise doubts about the company’s long-term prospects.

- Carry somewhat less risk than broader market. However, as they take time to turn around, value stocks may carry more risk of price fluctuation than growth stocks.

Growth or Value… or Both?

Which strategy — growth or value — is likely to produce higher returns over the long term? The battle between growth and value investing has been going on for years, with each side offering statistics to support its arguments. Some studies show that value investing has outperformed growth over extended periods of time on a value-adjusted basis. Value investors argue that a short-term focus can often push stock prices to low levels, which may create buying opportunities for value investors.

History shows us that:

- Growth stocks, in general, have the potential to perform better when interest rates are falling and company earnings are rising. However, they may also be the first to be punished when the economy is cooling.

- Value stocks, often stocks of cyclical industries, may do well early in an economic recovery but are, typically, more likely to lag in a sustained bull market.

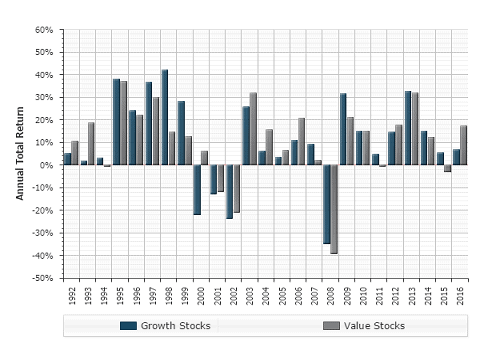

Growth vs. Value: Compare the Performance |

Both growth and value stocks have taken turns leading and lagging one another during different markets and economic conditions. |

Source: ChartSource®, DST Systems, Inc. Based on calendar-year returns from 1992 to 2016. Growth stocks are represented by a composite of the S&P 500/BARRA Growth index and the S&P 500/Citi Growth index. Value stocks are represented by a composite of the S&P 500/BARRA Value index and the S&P 500/Citi Value index. Past performance is not a guarantee of future results. Index performance does not reflect the effects of investing costs and taxes. Actual results would vary from benchmarks and would likely have been lower. It is not possible to invest directly in an index. © 2017, DST Systems, Inc. Reproduction in whole or in part prohibited, except by permission. All rights reserved. Not responsible for any errors or omissions. (CS000170) |

When investing long term, some individuals combine growth and value stocks or funds. This approach allows investors, in theory, to take advantage of different economic cycles and smooth out returns over time.