Teen and Summer Jobs: Lessons with Money

Teaching children about money is an endeavor that should begin as early as possible. Once they become teenagers the opportunities to drive home the message of money management are abundant. As summer job season approaches, your children will have an increased opportunity to earn money. Here are some of the most important things you can do for your teen to teach her or him about money during these first, impressionable experiences with income.

-

1

Open a Bank Account

Once that lifeguarding or day camp job is won, it’s a great time to take your teen to the bank to open a checking account. Many banks offer a high school account complete with a debit card. You can set a debit limit with you teen at the bank to ensure that they begin to understand the concept of budgeting once the payroll checks start arriving every other week. Our banker at Chase actually set an appointment with my sons and taught them the importance of safe guarding their PIN, how to use the ATM, and how to monitor their account online. (Once they are off to college, you can upgrade the account and give them more of a limit on their debit card.)

-

2

Open an IRA

Once your child has earned income, he or she can open up an IRA or Roth IRA. Last year my 18-year old read about Roth IRAs online and was immediately sold. He’s a good saver, and just like his Mom, he liked the tax-free feature!* While we told both of our boys, they need to save for all their spending money in college, their summer jobs would certainly yield enough to contribute a small amount in the Roth. (Anyone can contribute 100% of their earned income up to $5500 per year.)

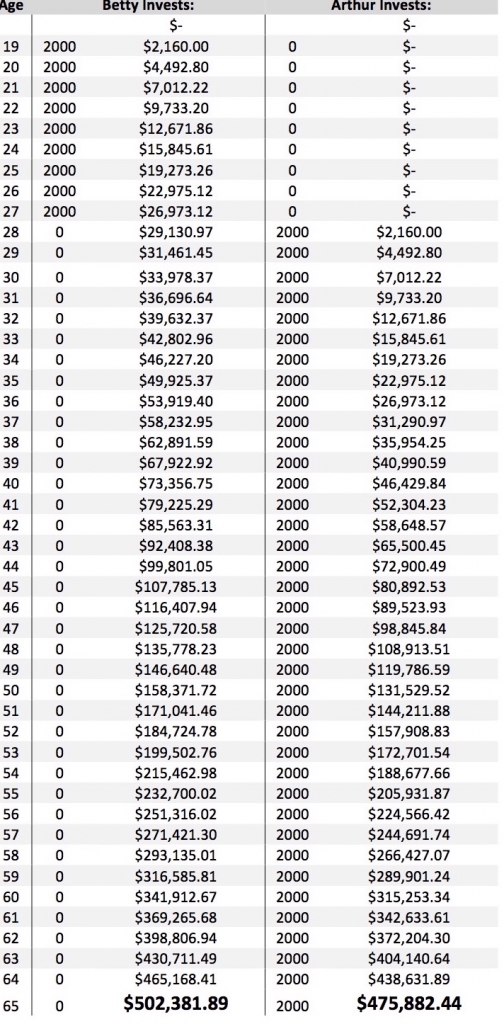

It’s important to share with them the importance of setting aside a small amount for their retirement someday. I recommend showing them the math. It is STAGGERING to see how much an IRA can grow exponentially over the years – especially if your young person starts early. As the graphic comparison below illustrates, Betty put away $2,000 a year for 9 years between the ages of 19 and 26. She never contributed to her IRA again. Arthur put away $2,000 a year every year between the ages of 28 and 65. BETTY CAME OUT AHEAD. At the age of 65, Betty’s account had grown to be $502,381 while Arthur’s was $475,887. I simply used an average 8% rate of return using Excel to do the math. Starting early is better! I know that this math made an impact on my boys and has made them aware that saving a small amount can add up over many years. Remember….always pay yourself first!

-

3

Encourage the Concept of “Skin in the Game.”

It’s easy to want to give your kids everything. Yet, giving them the opportunity to earn rewards and experience risk is the best lesson. One story about my son Kurt comes to mind. He came to me in 7th grade and asked for a new Apple laptop. There was nothing wrong with the one he had – it just wasn’t the latest and greatest. When he logged his request with me, he prepared with a list of reasons why a new computer was the right choice for him. And I agreed! With one caveat: he would have to pay for it. His birthday was coming up, and I told him that we would all give him money towards a computer instead of a gift. That wasn’t going to be enough, however, so my husband and I encouraged him to start babysitting and doing other odd jobs around the neighborhood during the summer. He worked hard and by the time the new school year rolled around, he was close…but $200 short. He, (like any of us would,) wanted the computer NOW. He asked for a loan to cover the last $200. I absolutely said no – the idea of credit was a bad one. Once he had the computer, the drive to earn the money would diminish. He could wait the couple of weeks until he had the $200 to be able to buy the computer. He did wait and a month later, he bought the computer with all of his own money. I saw a pride in his accomplishment and an appreciation for the computer that never would have existed if he had been given the computer 6 months before.

*Unless certain criteria are met, Roth IRA owners must be 59 ½ or older and have held the IRA for five years before tax-free withdrawals are permitted. Otherwise, taxes and a 10% penalty may apply to earnings withdrawn.